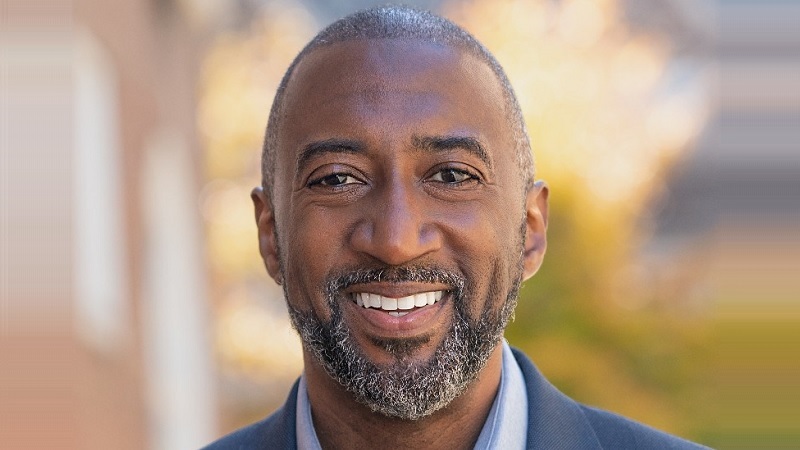

Squire Servance, Founder and Managing Partner of Syridex Bio, explains how his minority-led life sciences investment firm aims to address healthcare disparities.

What if you could improve health equity by convincing investors to finance the development of drugs and treatments to meet the needs of underserved communities and also bring them a good return?

That is exactly what Syridex Bio is aiming to do. Launched last year, this U.S. minority-led life sciences investment firm has its sights set on addressing healthcare disparities, particularly those that disproportionally affect people of colour.

Squire Servance says there are several determinants for why these disparities exist, including low investment into research and development for certain conditions and the lack of community support and access to quality healthcare.

“From my perspective, we wanted to focus on where we felt we could have the most impact and narrowed it down to driving innovation in the areas of the greatest disparities,” he says. “If we can do that, we can begin adding value and creating innovative drugs and treatments with broad market access.”

Disease focus

To this end, some of the disease categories of particular interest to Syridex Bio are high-burden and emerging infectious diseases, non-communicable diseases, autoimmune conditions, and maternal, newborn, and child health disorders. They have assessed conditions such as lupus, sarcoidosis, sickle cell and select rare diseases.

“Lupus, for example, is a nuanced illness. It is very difficult to get treatments for autoimmune disorders like this through clinical trials because the diseases are heterogeneous, making it difficult to design and conduct trials.”

There have only been two new drugs to treat lupus in the last 60 years available to the five million sufferers around the world. Servance suggests that big pharmaceutical companies had tended to ignore this in favour of treatments for “lower-hanging fruit.”

Switching from medicine to law

Servance originally wanted to be a doctor and double majored in biomedical engineering and cell biology & neuroscience. But then, ultimately, he decided that medicine wasn’t for him and became a lawyer instead.

“I felt that personality-wise, it wasn’t the best fit,” he admits. “I loved innovation and the sciences, but I didn’t think being a doctor day-to-day would suit me personally.”

After a spell clerking in the U.S. Federal Court of Appeals, he became a life sciences attorney at Morgan Lewis, writing patents and progressing to transactional work. This opened his eyes to the impact that investors could have on innovation and technology.

A chance meeting with the owner of a private equity and venture capital firm led him to move in-house and learn about business development. Before founding Syridex Bio, he worked for the bio-processing life sciences company Repligen Corporation as SVP, General Counsel and Corporate Secretary. Before that, he was with Baxter International, leading the global legal team for their $2bn+ pharmaceuticals business.

Addressing healthcare disparities

Servance had been nurturing the idea of setting up a private equity VC fund but was unsure how to differentiate. But then the COVID-19 pandemic highlighted how people of colour were disproportionally suffering from and dying from the disease.

“And you start to have conversations about why there are such big disparities and how to address that,” he explains. “It took some time to determine whether the business model of leveraging capitalism with the VC mindset to fuel health equity made sense. Ultimately, we reached the point where we felt we had a strong strategy.

“There are health equity-focused firms in the market, including some run by large Cities. Big pharma has impact funds and programmes directed to health equity, but no fund exists to invest specifically in therapies and drugs that treat diseases that disproportionately impact underserved communities.

“This is how we differentiate, and I think our approach is unique in that disparity is where we start when looking for deals. Our aim is to deploy capital in a way that can accelerate the development of innovative drugs in the areas of greatest need.”

Social justice

Servance is justifiably proud of what the company has achieved so far, particularly building a talented team that can identify and source opportunities and mitigate risks. Interestingly, being a minority-led firm has not been the primary driver of the firm’s success.

He says: “It’s the mission that drives it, and if you’ve bought into that mission, I don’t necessarily care what you look like. The focus is to excel in health equity.

“I’m really excited by the deals we are currently negotiating and hope we’re getting more and more people to talk about social justice in healthcare and to understand that they can make a difference by addressing it.

“Our goal is to acquire products and build standalone companies around them. Identifying people interested in running these companies is extremely important for us. So, money and people are the two biggest aspects.”

When asked why health equity was so important to him, Servance candidly replied: “I am a big proponent of giving back and using your skills and talents to help those in need.

“I’ve always had a passion for helping people, particularly people of colour. From a business standpoint, we designed a strategy that harnesses that you can earn money for a good cause.

“Everyone deserves a just and fair opportunity to live a healthy life. Dr Martin Luther King said that the arc of the moral universe is long but bends towards justice.

“If we, as a company, can be part of that arc towards justice, specifically in healthcare, I’d be happy.”